BerkShares going digital

Local alternative currency preparing for public launch of mobile app to align with today’s spending patterns

BY JOHN TOWNES

As physical cash becomes increasingly eclipsed by credit cards and other electronic transactions at the cash register, the regional alternative paper currency BerkShares is going digital as well.

BerkShares Inc., the nonprofit community-based organization that issues and manages the currency, is currently in the final stages of developing a mobile app that will enable consumers to establish a BerkShares digital wallet to make purchases at participating businesses and organizations using their smartphones.

The initiative is a sign of the times. It reflects the increased replacement of cash transactions with credit cards and mobile payment services such as Venmo, as well as the emergence of more esoteric financial systems such as blockchain.

“BerkShares has been a successful program, but it has become increasingly clear that we needed to adapt to the fact that people are not using cash like they did when we started,” said Rachel Moriarty, program administrator for BerkShares Inc. “We also have talked to merchants, and they have wanted a version of BerkShares that would be more convenient for them and better meet their needs.”

The organization is currently in the final stages of testing the app, which will be available for free for both iOS and Android phones. The plan is to release it in a public launch following the holidays in early 2022.

As an initial incentive promotion, they have received $60,000 in donations to give away 10 digital BerkShares to the first 6,000 Berkshire businesses and residents who download the app and set up a digital wallet (visit berkshares.org for details).

The paper BerkShares currency, which was introduced 15 years ago in 2006, will continue to be offered, operating in parallel with its digital counterpart.

Moriarty emphasized that, while the form will be different, digital BerkShares has the same purpose and role as the paper currency. Both are designed to cycle spending within the Berkshires by facilitating local transactions, rather than sending money outside of the Berkshires to remote corporate headquarters and financial institutions.

“The ethos and goals of BerkShares re-main the same,” she said. “This is simply an evolution. We expect that digital BerkShares will improve on the ability of the currency to support the Berkshire economy.”

She added that BerkShares also has an important educational component as a vehicle to encourage and demonstrate the importance of spending locally, as well as fostering the sense of community

“That will continue with the app, which will include features such as a community-oriented news feed and a searchable business directory,” Moriarty said. ”It will also allow us to better visualize in real-time how local spending circulates throughout the community.”

Currently about 400 businesses accept Berk-Shares, primarily in the southern Berkshires, with about 140,000 bills in circulation.

The organization had been considering moving to a digital currency for a while, according to Moriarty.

They decided to take the leap after being approached by Fennie Wang, founder and CEO of Humanity Cash, a company that is working to build “circular economies” through community currencies.

Wang has a background in law, finance and technology. Her experience includes positions as a securities analyst with JP Morgan and as a securities litigation and investigations associate with the law firm of Wilmer Hale, among others. More recently she worked with companies in blockchain and other alternative financial technologies and systems before launching Humanity Cash, which is registered as a public benefit corporation.

“I decided that I want to find ways to use these new financial systems and technologies such as cryptocurrency for social good, including supporting regional economies and community banks,” said Wang, whose company is based in New York. “I was familiar with Berk-Shares as a successful local currency. I contacted them about working together, and they agreed.”

Wang is collaborating with the organization to develop digital BerkShares. “Ideally, the goal is to create a currency that eventually will be a prototype for a ‘white label’ system that can be adopted by other communities,” she said.

Digital differences

While their purpose is similar, digital BerkShares will operate on a different basis than its paper sibling.

In both forms, BerkShares are tied to U.S. currency held in deposit accounts at participating banks. For paper BerkShares, these include Lee Bank, the Pittsfield Cooperative Bank, and Salisbury Bank.

With the paper bills, customers exchange their U.S. dollars for BerkShares in person at the banks. To provide an additional incentive for using BerkShares, the exchange rate is 95 cents U.S. for $1 in BerkShares, which provides a built-in discount when customers make purchases with them.

Merchants, in turn, can use the BerkShares they receive to make purchases at other participating businesses, or they can exchange them at the banks for U.S. dollars. The 95-cent exchange means they do not receive the full value of dollars, however.

The digital currency will be held on account at Lee Bank and Salisbury Bank. Responding to merchant feedback, rather than the 95 cents to $1 dollar exchange rate, digital BerkShares will be exchanged at a 1:1 rate.

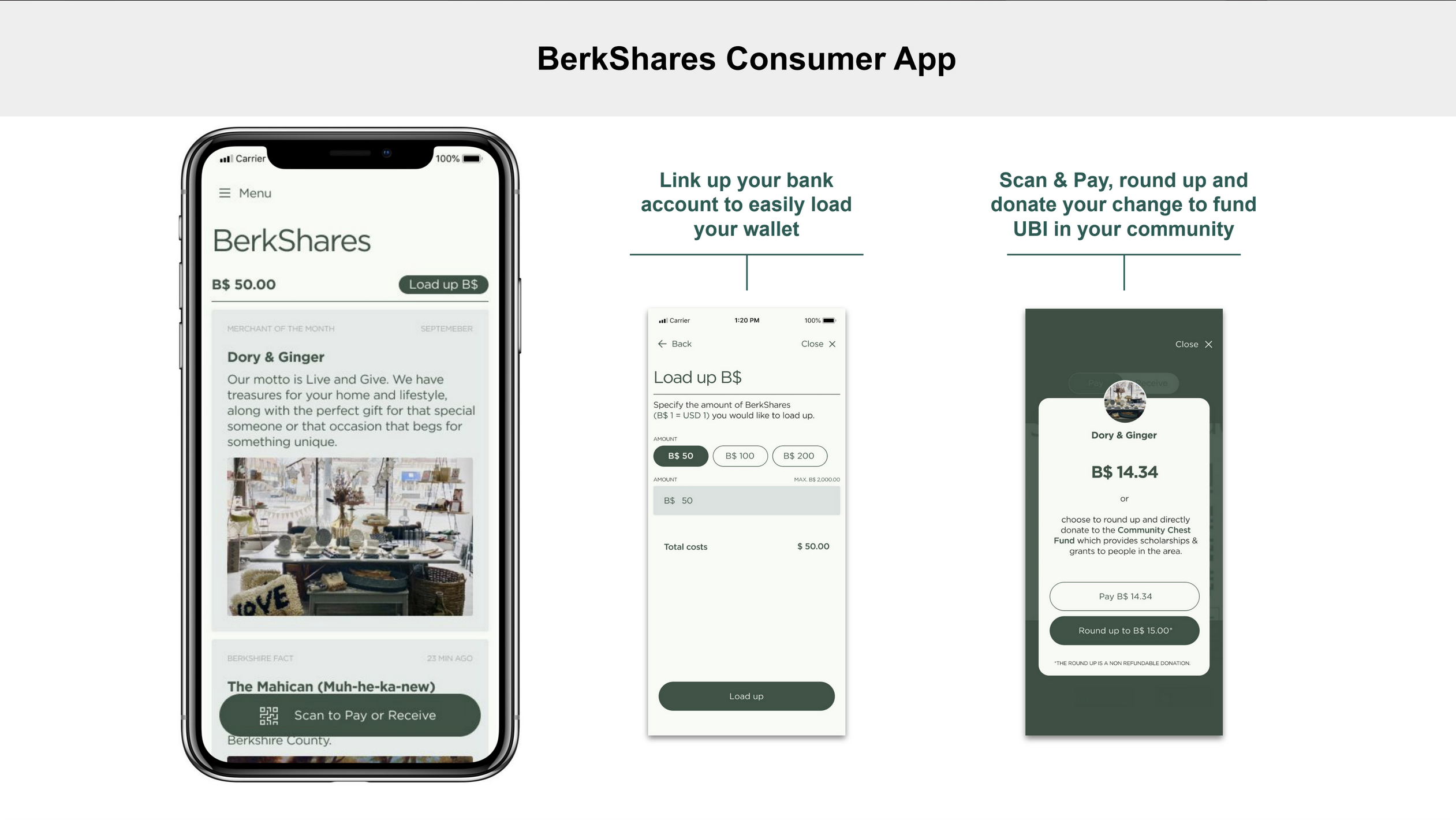

Customers will download and use the app to link their own account at any bank to BerkShares. They then use the app to transfer whatever amount they choose to create a digital wallet of BerkShares.

With the app, they can use their phones or tablets to make purchases in BerkShares at participating businesses, similar to how they would use a commercial mobile payment system such as Venmo. The merchant subtracts that amount from the buyer’s BerkShares account and transfers it into their own.

To conduct sales, merchants can place a static QR code next to their cash register, which the customer scans and then enters the price and shows the cashier to confirm. As an alternative, a merchant can generate a unique QR code on their own device, which will automatically pull the amount from the customer’s BerkShares account.

BerkShares can also be used to transfer money from one person to another or to an organization. Initially, such transfers will have to be made with both parties at the same location, but an option to do that from different locations is being planned.

Moriarty emphasized that digital Berk-Shares have been designed to make it as convenient and seamless as possible for businesses and organizations to become participants by signing up for BerkShares. “We talked with businesses and listened to their concerns about BerkShares, and their suggestions for what they wanted to see,” she said.

Vendors can handle everything related to BerkShares through their own app. Also, unlike the paper version, they do not have to have an account or physically go to one of the collaborating banks to convert them into U.S. dollars. “Hopefully, that will also allow BerkShares to geographically expand its network of businesses into other sections of the Berkshires,” Moriarty said.

Accepting digital BerkShares also enables businesses to conduct electronic transactions at a lower cost than credit cards.

“With credit cards, merchants have to pay a processing fee of 2 or 3 percent, which can add up to a significant amount, especially for a small business,” she said. “With BerkShares, they do not pay a transaction fee. There is a fee of 1.5 percent if they cash them out for U.S. dollars, but that is notably less than what they pay for credit card fees.”

If they use the digital BerkShares to make purchases at other businesses that accept them, they are not paying any fee, she added.

Moriarty said digital BerkShares also can be easily integrated with a business’s other accounting, inventory and payment systems.

Future features are slated to include the ability to offer subscriptions, loyalty programs, and exclusive sales for BerkShares users.

Wang noted that digital currencies also have the potential to strengthen and expand the mission of organizations like BerkShares, by keeping more of the money generated by transactions and fees within the community.

“Strengthening the local economy goes beyond just where the money is spent,” said Wang. “What also matters is where your money goes ultimately. When you use a large national system like Venmo to set up a digital wallet, that money is deposited at large outside banks with no connection or responsibility to the community. With a system like Berk-Shares, it goes to community banks.”

She added it also has the potential for other benefits, such as providing resources to create funds earmarked for other social goals such as investing in local farms.

Transaction process

Behind the scenes, digital BerkShares will utilize blockchain technology to facilitate the ongoing transactions.

Blockchains and cryptocurrencies are alternative systems for financial transactions and investments that have become increasingly prominent. They have also been controversial, due to their complexity, lack of transparency and other factors, including the amount of energy used to power the immense computers the systems utilize.

Wang acknowledged that these systems have a darker side, but she said the technology and infrastructure can also be used in beneficial ways. She said the primary advantage for BerkShares is the ability to handle transfers of money almost instantaneously, rather than being put on hold for several days, as in legacy banking systems.

BerkShares is utilizing an open-source platform called Celo, developed by a nonprofit organization with the stated goal of creating “an inclusive financial system that creates the conditions for prosperity for everyone.” It also operates on a carbon-neutral basis.

The ongoing transactions will occur separately from the involvement of the two local banks where the holding accounts are based.

“We’re basically the vault where the money to back BerkShares is kept as an account,” said Chuck Leach, president of Lee Bank. “All of the interactions of sales and transfers within that are handled by an Automated Clearing House.”

Leach said that Lee Bank agreed to participate in the new digital currency because it has supported BerkShares from its early days. “We believe BerkShares are good for the Berkshire economy and the community in many ways,” he said. “We see this as the next chapter that will make it easier to use BerkShares all the way around.”

However, Leach acknowledged that he and the bank’s management were initially hesitant when they were first approached by Berk-Shares to participate in the digital currency.

“We were skeptical and risk-averse about it,” he said. “That was primarily because it involved blockchain. We were concerned about that. But Fennie Wang made a convincing case for it, and once she explained why they wanted to use it, we agreed.”

Leach added that, from the bank’s standpoint, it is also a learning opportunity.

“Whether we like it or not, systems like blockchain are coming at us all, like a train heading down the track,” he said. “It’s going to be transformational. Sooner or later it will impact every business large and small. And financial institutions are going to have to adjust and learn to deal with them.”

He said his bank decided that BerkShares was an opportunity to gain firsthand experience in how these systems work with no risk.

“We’re not taking a plunge into blockchain or making any speculative investment,” he said. “The way this is structured, it’s more like we’re dipping the tip of one toe into the water. BerkShares is just one account and does not affect the bank overall.”

Leach added that he sees digital Berk-Shares as especially beneficial for businesses here. “Merchants lose with [credit card] swipes because they get clipped by fees,” he said. “This is a way around that for them. That’s just one way this can be good for business and the economy here.”◆

This story was originally published in the December 2021 issue of the Berkshire Trade and Commerce, linked here.